Get the free returns proforma invoice

Show details

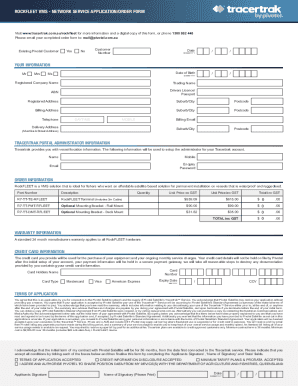

RETURNS PROFORMA INVOICE IN ACCORDANCE WITH CUSTOMS REGULATIONS, PLEASE SELECT BELOW THE ITEMS YOU WOULD LIKE TO RETURN. COMPLETE THIS FORM AND GIVE 5 COPIES TO THE COURIER OF YOUR RETURN. GOOD REPORTER

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign returns invoice form

Edit your returns proforma invoice form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your returns proforma form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing returns proforma invoice template online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit returns proforma form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

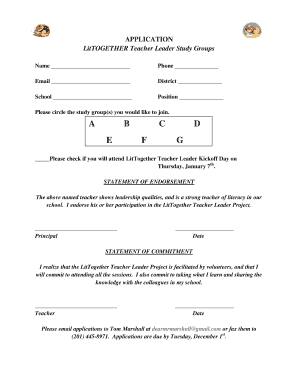

How to fill out returns proforma template

How to fill out Returns Proforma Invoice

01

Start by entering the seller's information at the top of the form, including name, address, and contact details.

02

Fill in the buyer's information next, providing their name, address, and contact details.

03

Add the date of the invoice and a unique invoice number for reference.

04

List the items being returned in a detailed manner, including descriptions, quantities, and unit prices.

05

Clearly state the reason for the return beside each item, if necessary.

06

Calculate the total amount for the returned items and ensure it's clearly displayed.

07

Include terms and conditions or any specific instructions regarding the returns process.

08

Review the entire invoice for accuracy before submission.

09

Sign and date the invoice where required.

Who needs Returns Proforma Invoice?

01

Retailers handling returns from customers.

02

Businesses needing to document returned items for accounting purposes.

03

Suppliers requiring a formal request for item returns.

04

Individuals returning items for purchase verification or warranty claims.

Fill

returns proforma pdf

: Try Risk Free

People Also Ask about returns proforma search

What is the meaning of in proforma?

A pro forma is a document made before the actual sale of goods or services. This document is issued by the retailer or supplier to the customer or buyer who is enquiring for the goods or services.

Can you ship with a proforma invoice?

A pro forma may not be a required shipping document, but it can provide detailed information that buyers need to legally import the product. The invoices inform the buyer and the appropriate import government authorities details of the future shipment; changes should not be made without the buyer's consent.

What does pro forma mean in shipping?

A pro forma invoice is a quote in an invoice format that may be required by the buyer to apply for an import license, contract for pre-shipment inspection, open a letter of credit or arrange for transfer of hard currency.

What does pro forma mean Fedex?

The pro-forma invoice is a preliminary bill of sale issued prior to shipping the goods. A Commercial Invoice is prepared by the exporter and is required by the foreign buyer to prove ownership and arrange for payment. The CI is required for all international shipments.

Is a proforma a receipt?

A pro forma invoice is sent in advance of the commercial invoice. It is a preliminary invoice that estimates the final cost of a sale. A receipt is a document that serves as evidence of payment made by the buyer to the seller.

What is a return proforma invoice?

A proforma invoice is a preliminary bill or estimated invoice which is used to request payment from the committed buyer for goods or services before they are supplied. A proforma invoice includes a description of the goods, the total payable amount and other details about the transaction.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is returns proforma?

Returns proforma refers to an estimate or projection of the expected returns or profitability of an investment or business venture. It is a financial statement that outlines the anticipated financial results based on certain assumptions and calculations. The proforma often includes revenue forecasts, expense projections, and estimated profits or losses. It serves as a planning tool to assess the economic feasibility of an investment opportunity or to make informed decisions regarding business strategies. Additionally, returns proforma may be used for financial analyses, investment evaluations, or fundraising purposes.

Who is required to file returns proforma?

The term "proforma" typically refers to a financial statement that is prepared in advance of a planned transaction. Therefore, it is not directly related to filing tax returns. However, if you are referring to a specific context or requirement regarding the filing of proforma returns, please provide more information.

How to fill out returns proforma?

To fill out a returns proforma, follow these steps:

1. Start by stating the name and contact information of the person or company making the return, including name, address, phone number, and email.

2. Provide the date of the return proforma.

3. Include a unique identification number or reference number for easy tracking.

4. Next, specify the details of the product being returned, such as the product name, quantity, product code or SKU, and a brief description of the item.

5. Mention the reason for the return. This could be due to a defect, damaged during shipping, wrong product received, or any other relevant details.

6. Indicate whether the customer or sender is requesting a refund, replacement, or exchange.

7. If the return involves a refund, mention the payment method used for the original purchase (e.g., cash, credit card) and provide details of the account where the refund should be processed, such as bank name, account number, and account holder name.

8. If a replacement or exchange is requested, specify the preferred replacement item or its details (e.g., size, color).

9. Include any additional notes or instructions related to the return, such as requirements for packaging or returning the item.

10. Finally, include a section for authorized signatures from both the sender (customer) and receiver (company) to acknowledge and approve the return.

Ensure that all the information provided is accurate and complete before submitting the returns proforma.

What is the purpose of returns proforma?

The purpose of a Proforma return is to provide a hypothetical or projected estimate of the financial performance of an investment or business. It helps in analyzing the potential profitability and viability of a project or investment by forecasting income, expenses, and overall financial outcomes. It enables investors, lenders, or stakeholders to understand and evaluate the potential return on investment before making any financial decisions.

What information must be reported on returns proforma?

When creating a proforma return, the following information must be reported:

1. Seller's details: The name, address, and contact information of the entity or individual returning the goods.

2. Buyer's details: The name, address, and contact information of the original purchaser or recipient of the goods.

3. Invoice/Order details: The original invoice or order number, date, and other relevant identifying information for the initial purchase or transaction.

4. Product details: A description or item code of the goods being returned, including quantity, unit price, and total value.

5. Reason for return: A clear explanation of why the goods are being returned, such as defects, damaged in transit, wrong item received, or cancellation of the order.

6. Return authorization: If the seller has a return policy that requires obtaining authorization before returning goods, the proforma return should include the authorization number or documentation.

7. Return shipping instructions: Instructions on how the goods should be returned, including the preferred shipping method, address, and any specific packaging requirements.

8. Return terms and conditions: Any additional terms and conditions related to the return, such as restocking fees, time limits for returns, or special conditions for specific products.

9. Signatures: The proforma return should be signed by an authorized representative of the seller and, in some cases, the buyer to acknowledge and agree upon the return terms.

It's important to note that the specific information required on a proforma return may vary depending on the company's policies and the relevant legal requirements.

How can I modify returns proforma fillable without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including returns proforma get, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How do I make changes in returns proforma print?

With pdfFiller, the editing process is straightforward. Open your returns proforma download in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How do I edit returns proforma make in Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing returns proforma trial and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

What is Returns Proforma Invoice?

A Returns Proforma Invoice is a preliminary document issued prior to the return of goods, outlining the items and their values to facilitate the process of returning multiple items, ensuring clarity between the seller and the buyer.

Who is required to file Returns Proforma Invoice?

Typically, sellers who are accepting returned items from customers or buyers who wish to send back goods to the seller are required to file a Returns Proforma Invoice as part of the returns process.

How to fill out Returns Proforma Invoice?

To fill out a Returns Proforma Invoice, enter your business details, the buyer's information, a description of the items being returned, their quantities, values, reasons for the return, and any reference numbers related to the original invoice.

What is the purpose of Returns Proforma Invoice?

The purpose of a Returns Proforma Invoice is to provide a clear and official record of the products being returned, ensuring that both parties have a mutual understanding of the return terms and conditions, and aiding in the processing of the return.

What information must be reported on Returns Proforma Invoice?

The Returns Proforma Invoice must report information such as the seller's and buyer's contact details, detailed descriptions of the returned items, their quantities and values, return reasons, and reference numbers from the original purchase.

Fill out your returns proforma invoice online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Returns Proforma Fill is not the form you're looking for?Search for another form here.

Keywords relevant to returns proforma printable

Related to returns proforma edit

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.